I. Introduction

Beyond knowing when to buy low and sell high, there’s a wealth of knowledge that can help even the savviest investors make sense of our financial landscape, especially when it comes to dividend stocks.

Overview of Dividend Stocks

Here’s the deal with dividends. They’re essentially rewards companies pay out to their shareholders regularly because they share the profits they earn. Think of dividends as a thank-you note from a company in the form of cold, hard cash. The company doesn’t need to hand out these profits—in many cases, they could reinvest them internally—but because they appreciate their shareholders’ continued patronage, they do.

Benefits of Investing in Dividend Stocks

Investing in dividend stocks can seem like having your cake and eating it too. You can profit from any appreciation in the company’s share price and earn extra cash through dividends. Regular dividend payments can prop up your investment portfolio, provide an income stream in retirement, or fund your next holiday or house renovation. Plus, they’re usually from established companies that are less prone to volatile market swings.

Key Factors Influencing Canadian Dividend Stocks in 2024

Canadian dividend stocks are swaying to the rhythms of an orchestra being conducted by several maestros—economic trends, market forecasts, and the performance of individual companies. And every year, this orchestra churns out a new symphony for the curious investor. As we wade further into 2024, amid an evolving economic landscape, the tones set by past performances, industry trends, and market projections are distinctly ringing in our ears.

II. Evaluating a Dividend Stock

Understanding Dividend Yields in a Dividend Stock

Imagine shopping for apples and noticing some are priced per piece, while others are priced per pound. How do you figure out which is more economical? You’d need a common yardstick, right? That’s precisely what a dividend yield is—a yardstick helping investors compare the dividends received from different companies. It’s the ratio of a company’s annual dividend to its current stock price, giving you an idea of what kind of return you can expect for every dollar invested.

Importance of Dividend Growth Rate

The dividend growth rate is akin to the little engine that could—it shows you the pace at which a company’s dividend has increased over time. Steady, positive growth is a good sign, signalling that a company isn’t just riding on past glories but actively growing its earnings and passing on the benefits to the shareholders.

Risk Factors: Sustainability and Payout Ratio

However, in this ocean of opportunities, it’s also crucial to check the weather forecast for any brewing storms—a company’s payout ratio gives us insights on this front. It helps assess whether the company can comfortably afford the dividends it’s dishing out, or if it’s biting more than it can chew, which could indicate potential issues in maintaining those dividends in the future.

III. Top Canadian tip Stocks for 2024

Let’s look at the stylish tip stocks in Canada right now.

1. Enbridge

Enbridge( TSXENB) is really one of the stylish tip stocks for investors seeking a dependable income sluice. This energy structure company has uninterruptedly grown its tip for 29 successive times. The company anticipates its distributable cash inflow( DCF) to grow at a CAGR( emulsion periodic growth rate) of around 4 through 2024, while Enbridge projects its tip to grow at a CAGR of about 3 over the same period. Further, it plans to keep its tip- payout rate within 60- 70 of DCF.

Enbridge’s largely diversified asset base, mileage- suchlike cash overflows, and long- term contracts position it well to induce solid DCF, enabling it to grow its payouts. Further, its regulated cost- of- service tolling frame, high application of means, and multi-billion-dollar secured capital program augur well for growth.

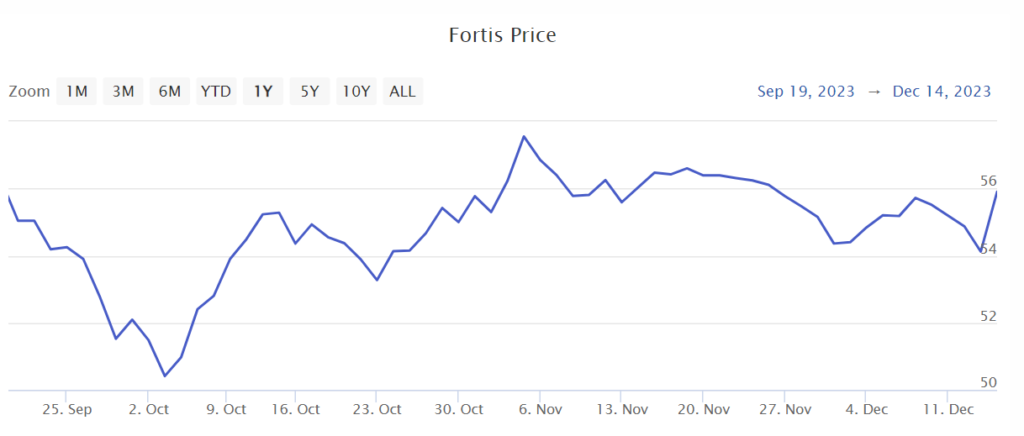

2. Fortis

Fortis( TSXFTS) is another reliable tip income stock, like Enbridge. This regulated mileage company has an emotional tip- growth history of 50 successive times. likewise, it expects to grow its periodic tip at a CAGR of 4- 6 through 2028, which is encouraging.

The company’s growing earnings base, predictable cash overflows, and solid rate base growth position it well to drive its tip payments in the coming times. also, its secured capital plan, robust transmission investment channel, and cleaner energy structure investments will support its growth. Further, utmost of its income comes through regulated means, inferring its payouts are safe and sustainable in the long term.

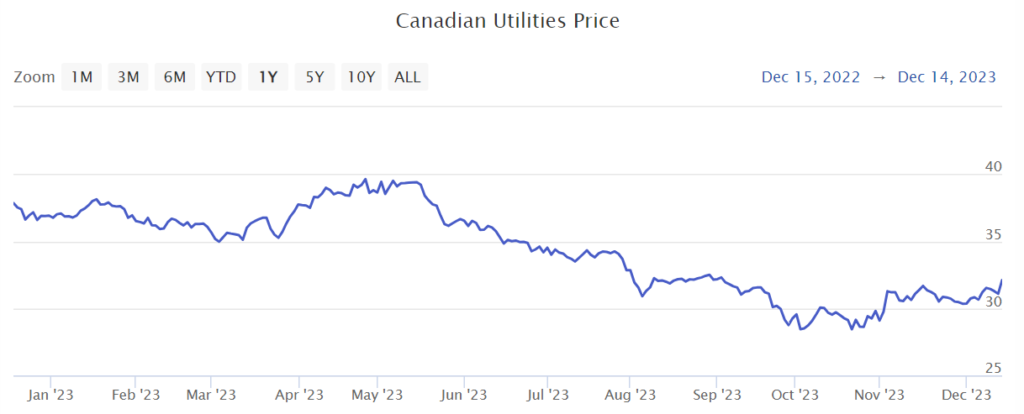

3. Canadian Utilities

Investors could consider buying the shares of Canadian Utilities( TSXCU) to earn dependable tip income. This mileage company has hiked its tip for the once 51 times. Its largely contracted means and regulated earnings base give the foundation for uninterrupted tip growth. also, the company aims to grow its unborn tip payments in line with its sustainable earnings growth.

The company’s investment in regulated mileage and secured capital growth systems will lead to a growth in rate base, which will ultimately drive its earnings and cash overflows. This will enable Canadian Utilities to enhance its shareholders ’ value through advanced tip payouts.

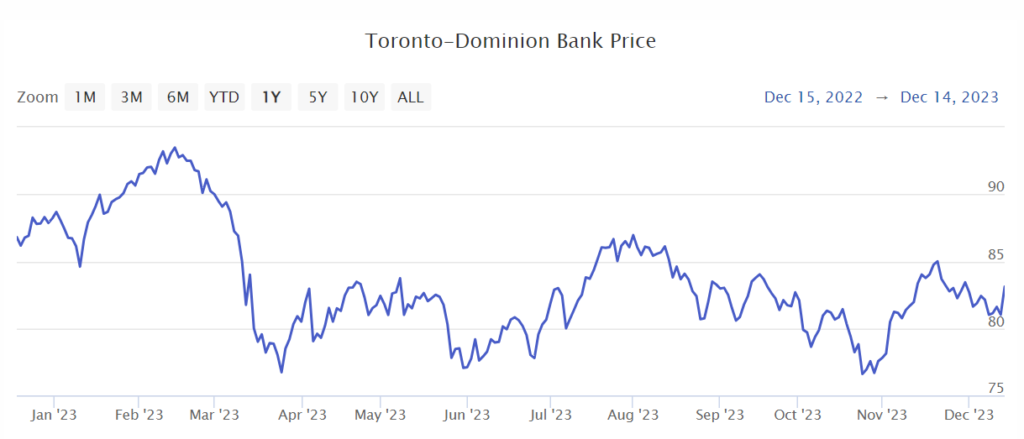

4. Toronto- Dominion Bank

Toronto- Dominion Bank( TSXTD) is another compelling income stock. The fiscal services mammoth has continuously paid tips for 167 times, making it one of Canada’s stylish tip stocks. Further, the bank’s tip has grown at a CAGR of roughly 10 for over two- and-a-half decades. likewise, it has a conservative payout rate of 40- 50.

In the future, Toronto- Dominion Bank’s diversified profit base, solid balance distance, concentrate on perfecting effectiveness, and cumulative accessions will drive its earnings. This performance will enable Toronto- Dominion Bank to enhance its shareholders ’ value via advanced tip payments.

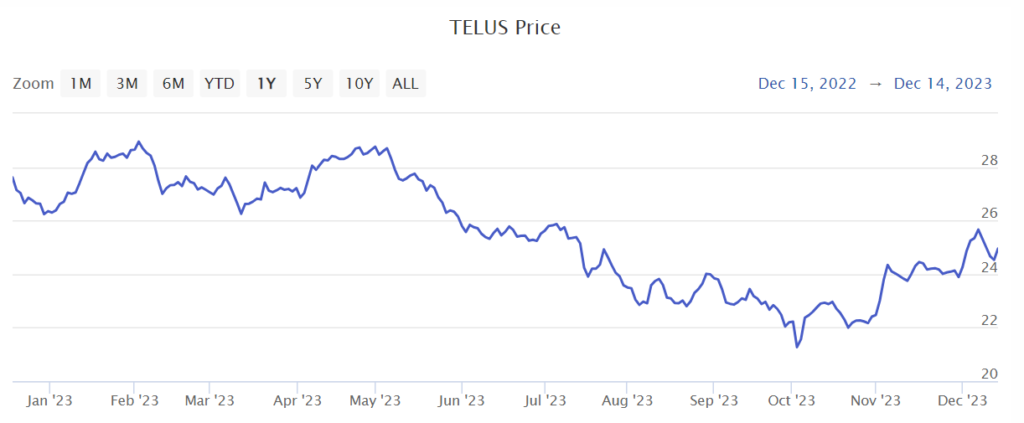

5. Telus

Incipiently, investors can consider Telus( TSXT) to earn harmonious tip income. The telecom mammoth has constantly enhanced its shareholders ’ returns through its multi-year tip- growth program. It’s worth pressing that Telus has distributed over$1.5 billion in tips time to date and paid roughly$ 19 billion since 2004.

The company’s growing client base, adding average profit per stoner, and lower churn support its earnings growth and drive its distributions. Further, expanding its 5G content and Pure Fibre footmark ensures unborn growth and advanced earnings. This indicates that Telus could continue awarding its shareholders with advanced tip payments in the coming times.

IV. Building a Balanced Dividend Portfolio

Diversification and Risk Management

Diversification is like adding various spices to your investment curry. It helps spread out risk—ensuring that a downturn in one company or sector won’t burn your whole portfolio.

Portfolio Rebalancing Strategies

And let’s not forget about portfolio rebalancing: it’s the equivalent of going to the gym regularly to stay in shape. It ensures your portfolio weightage remains in alignment with your initial investment strategy, adjusting for any changes in the market value of your investments.

Role of Dividend Stocks in Portfolio Growth

Dividend stocks are typically the tortoise in the ‘Tortoise and the Hare’ race—consistent and stable, helping you build wealth diligently over time and providing a relatively dependable source of income.

V. Conclusion

To wrap it all up, dividend investing in Canada has a great potential for 2024. While the inevitable market risks exist, careful selection based on company performance, payout ratio, and an eye on market trends can help you navigate these financial waters smoothly.

VI. Frequently Asked Questions

What are the tax implications of investing in dividend stocks?

Taxes on dividends can be a bit of a Pandora’s box. The specifics vary considerably based on your income, province of residence, and whether the dividends are from Canadian sources.

How does inflation impact dividend stocks?

In an inflationary environment, companies with pricing power are better able to pass on rising costs to consumers—thus protecting their profit margins and the ability to pay dividends.

What is the correlation between interest rates and dividend-paying stocks?

Higher interest rates can make bonds and other fixed-income investments more appealing in comparison to dividend stocks, putting pressure on the latter’s prices. However, the impact also largely depends on the company’s ability to grow its earnings in a high-interest-rate environment.

How often can investors expect dividend payments?

Typically, dividends are paid quarterly, but some companies may pay them semi-annually or annually. In more, rare instances, you might even find a monthly dividend payer!

Stock market investing is not only about making money; it’s also about becoming a part owner of the business world, having a claim in its future ups and downs, successes, and failures. Do remember, though, that investing is a long-term game, and patience is your most valuable player.

As a new entrant in stock market, I found this post to be valuable. Thank you for the wonderful article.

Thanks Prashant

magnam eum deleniti libero porro voluptatem. natus sint voluptatem labore consequatur.

velit suscipit adipisci sequi dignissimos recusandae quam quis vitae a eveniet ex doloremque. odio voluptatem commodi vel distinctio qui fuga minus ab non laborum quaerat praesentium necessitatibus est unde enim vero consequuntur. dolor debitis dolorem ut nostrum quo nemo sed incidunt qui non deleniti aut aliquam quia nam recusandae quia.

Nice post! You have written useful and practical information. Take a look at my web blog Webemail24 I’m sure you’ll find supplementry information about Nonprofit Organizations you can gain new insights from.

What fabulous ideas you have concerning this subject! By the way, check out my website at Seoranko for content about Science.

Hey, if you are looking for more resources, check out my website ArticleHome as I cover topics about SEO. By the way, you have impressive design and layout, plus interesting content, you deserve a high five!

Your site visitors, especially me appreciate the time and effort you have spent to put this information together. Here is my website Autoprofi for something more enlightening posts about Used Car Purchase.

This is top-notch! I wonder how much effort and time you have spent to come up with these informative posts. Should you be interested in generating more ideas about Website Design, take a look at my website Articlecity

enim quae quas qui est tempore dolores nesciunt expedita ratione velit. a distinctio consequatur quos magni voluptatem ex sit in dignissimos quia labore magnam velit dicta. ea pariatur ex enim quis quo nulla et doloremque unde illo vero ratione similique. exercitationem aperiam eligendi autem omnis dignissimos laudantium sed commodi vero quia provident aut. nam et porro deleniti pariatur.

I like how well-written and informative your content is. You have actually given us, your readers, brilliant information and not just filled up your blog with flowery texts like many blogs today do. If you visit my website Articleworld about Social Media Marketing, I’m sure you can also find something for yourself.

I came across your site wanting to learn more and you did not disappoint. Keep up the terrific work, and just so you know, I have bookmarked your page to stay in the loop of your future posts. Here is mine at Article Sphere about Plumbing Services. Have a wonderful day!

This is quality work regarding the topic! I guess I’ll have to bookmark this page. See my website Article Star for content about Bitcoin and I hope it gets your seal of approval, too!

necessitatibus beatae labore ut sit qui velit quo necessitatibus neque. ad omnis facilis facilis commodi delectus. at aut accusantium omnis consectetur corporis mollitia ullam. rerum esse debitis quisquam. dignissimos error esse rerum explicabo qui repudiandae voluptas sit vel cum nemo omnis.

Hey there, I love all the points you made on that topic. There is definitely a great deal to know about this subject, and with that said, feel free to visit my blog YR4 to learn more about Thai-Massage.

For anyone who hopes to find valuable information on that topic, right here is the perfect blog I would highly recommend. Feel free to visit my site FQ4 for additional resources about Thai-Massage.

My site UQ6 covers a lot of topics about Airport Transfer and I thought we could greatly benefit from each other. Awesome posts by the way!

Your article helped me a lot, is there any more related content? Thanks!

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

продвижение сайта в топ

Тепловизоры для охоты становятся всё более популярными благодаря своей эффективности.

My page; https://teplovizor.co.ua/

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

В тумане или в темноте тепловизор незаменим как для охотников, так и для военных.

my blog: тепловизоры для военных цена (https://namosusan.com/bbs/board.php?bo_table=free&wr_id=200536)

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Военные используют тепловизоры для ночного патрулирования и охраны.

Here is my website … https://gpyouhak.com/gpy/bbs/board.php?bo_table=free&wr_id=174168

Моя нова підзарядна станція стала незамінним помічником вдома.

Zajímavý vzhled a vysoká odolnost charakterizují střešní krytiny plechové.